Intel Shares Soar 30% After Nvidia's $5B Investment and Chip Partnership

- by Editor

- Sep 19, 2025

Credit: Freepik

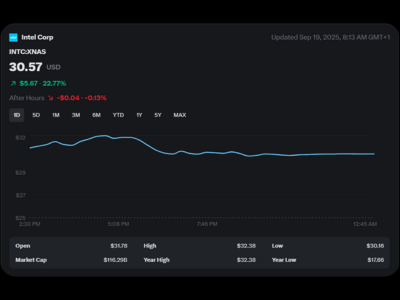

Intel Corporation saw its stock surge 30% in pre-market trading on September 18, 2025, reaching around $32 per share, following Nvidia’s (NASDAQ: NVDA) announcement of a $5 billion investment to acquire a roughly 4% stake in the struggling chipmaker at $23.28 per share, coupled with a strategic partnership to co-develop AI and computing chips for PCs and data centers.

The deal, detailed in Nvidia’s press release, integrates Intel’s x86 architecture with Nvidia’s NVLink system, enabling faster data transfers for AI workloads. Intel will manufacture custom x86 CPUs for Nvidia’s AI infrastructure and develop x86 system-on-chips (SoCs) embedding Nvidia’s RTX GPU chiplets for consumer PCs, aiming to challenge rival AMD. Nvidia CEO Jensen Huang called it a “historic collaboration” to fuse their ecosystems, while Intel CEO Lip-Bu Tan emphasized leveraging Intel’s manufacturing and packaging strengths for “new breakthroughs.”

This follows a turbulent period for Intel, marked by an $18.8 billion 2024 loss and a 10% U.S. government stake ($10 billion via CHIPS Act funds) in August, alongside Japan’s SoftBank’s $2 billion investment.

President Trump’s earlier call for Tan’s resignation over alleged Chinese ties, followed by a reversal post-meeting, added drama. Analyst Dan Ives dubbed it a “game changer,” positioning Intel as an AI catalyst after years of trailing Nvidia and AMD.

Nvidia’s shares rose 3.4% pre-market, buoyed by the deal and its $14 billion UK AI infrastructure pledge during Trump’s state visit. However, posts on X highlight concerns, noting Nvidia’s blocked China sales and CEO Huang’s $90 million share dump, suggesting potential market volatility.

China’s push for domestic chips, led by Huawei’s new AI cluster, adds pressure. Intel’s rally, while significant, faces scrutiny over its $44 billion debt and foundry losses, though the Nvidia partnership and government backing signal a revitalized role in the AI race.

0 Comment(s)